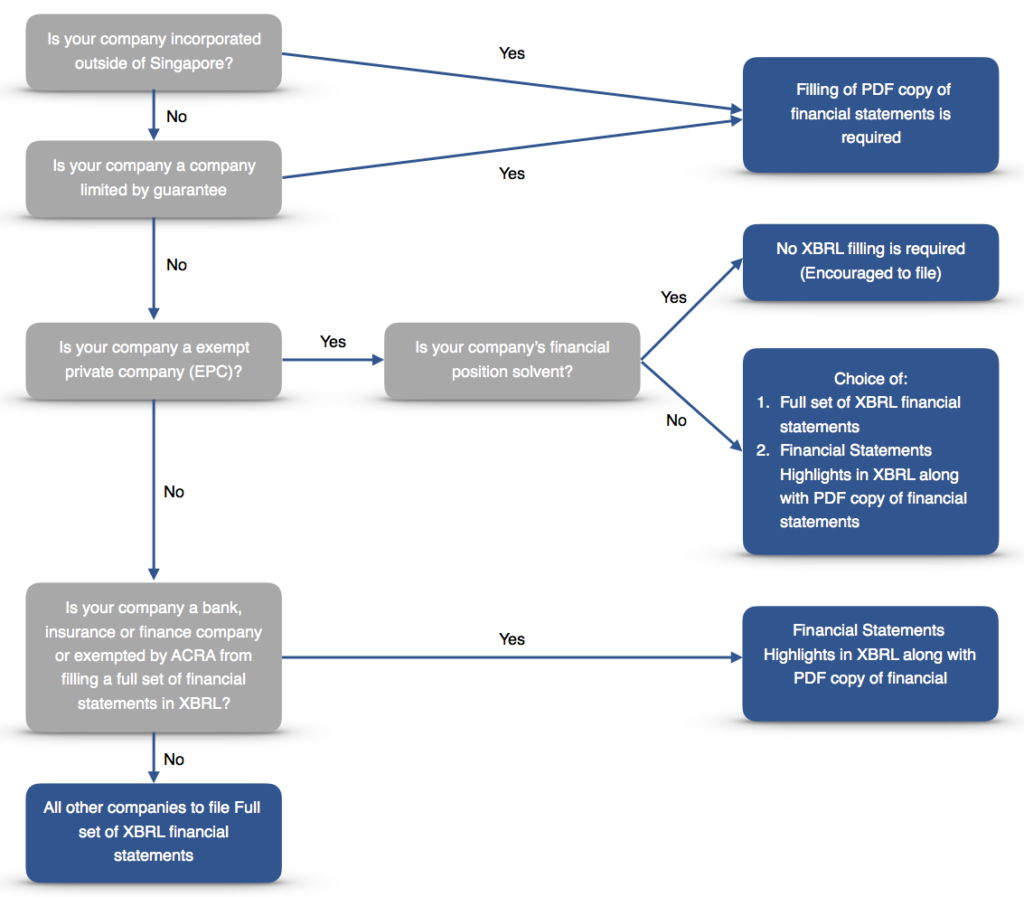

Accounting and Corporate Regulatory Authority (ACRA) in Singapore has made filing an XBRL based report along with the usual ACRA requirements mandatory for all companies since 2014, whether limited or unlimited by shares. This meant that registered companies could no longer file a partial XBRL report as they did so previously.

Under the new requirements, there are only two types of XBRL filing available, which are the Financial Statement Highlight (FSH) and the full set of financial statements in XBRL filing.

FSH filing is only allowed for a few specific companies, namely the commercial banks, merchant banks, licensed insurers and finance companies regulated by MAS, along with other companies allowed by law to prepare accounts in accordance with accounting standards other than SFRS, SFRS for Small Entities, IFRS and Insolvent Exempted Private Companies (EPCs). These companies are the only ones allowed to submit an FSH along with a PDF copy of their financial statements.

Solvent EPCs are exempted from filing FSH, Full XBRL, or PDF copy of their financial statements, but they are encouraged to so. Companies limited by guarantee and foreign corporations are only required to file PDF copy of their financial statements.

All other companies not listed above are required to submit the full set of financial statements in XBRL format.